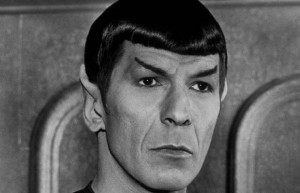

Vulcan (Alta.) rolls out grand homecoming for Spock

VULCAN, Alta. — Despite a spell of unwelcoming hail, rain and snow, Mr. Spock finally arrived in the small Alberta town of Vulcan on Friday, ending what some say has been a 10-year quest to bring the half-human, half-Vulcan home.

Dressed casually in a grey sweater and black pants, a beaming Leonard Nimoy arrived without his trademark Vulcan ears to hundreds of cheering fans Friday afternoon outside the Vulcan Tourism Centre before joining a parade down the town’s main drag to help celebrate the town’s new status as the Star Trek capital of Canada.

By the time the 79-year-old actor offered his “live-long-and-prosper” handprint and unveiled a bronze bust of his most famous character, the sun was shining and the crowd had surged to an estimated 2,500 people.

“Wait until Bill Shatner hears about this,” said Nimoy. “I have been a Vulcan for 44 years. It’s about time I came home.”

For town officials, it was the end to a long, weird and exhilarating quest to bring Spock home.

In town for only a couple of hours, the actor is scheduled to be a guest at The Calgary Comic and Entertainment Expo this weekend. Vulcan is about 100 kilometres southeast of Calgary.

Nimoy’s appearance caps off a decade-plus campaign to use Gene Roddenberry’s popular Star Trek phenomenon to boost tourism for the town, which was actually named after the Roman god of fire.

“I think this is going to go down as one of the biggest days in Vulcan history,” says Dayna Dickens, the town’s tourism co-ordinator. “You know, certainly there’s be some controversy with the town having its traditional Prairie roots. But I think the town has come together to welcome Mr. Nimoy here.”

Certainly there was no sign of dissent along Vulcan’s quaint main drag. A pharmacy, an insurance office, the local tavern and even one abandoned building had been turned into makeshift shrines to Spock. New T-shirts had been designed, and a limited edition poster was produced that pictured a Andy Warhol-like portrait of the pointy-eared first officer of the Enterprise with the caption “Welcome Home.”

Star Trek movie marathons and the original series’ score blasted from the windows of local businesses and the liquor store was enjoying brisk sales of Romulan ale. Vulcan jerky was being sold at the grocery shop and two high school students were dressed up as “sehlats” — bear-like creatures native to Vulcan. Town officials, including Mayor Tom Grant, were decked out in full Star Trek garb.

Nimoy lent a pair of his Vulcan ears and a poster signed by the original cast to the town to display for a year.

Nimoy, who recently announced his retirement from acting, was clearly touched by the attention.

“I’ve never had an experience quite as touching as I’m having here today and I appreciate it,” he said. “I’m just sorry it took me so long to get here.”

For some of the town’s older residents, the visit was indeed a long time coming.

“People thought they were crazy when (officials) started talking about Star Trek and they thought they were really crazy when they built the Trek centre but it’s really been wonderful,” says Betty McFadden, 75, referring to the town’s Starship Enterprise-styled tourism building.

McFadden, who has been in Vulcan since 1952, wandered the main drag with her friend Betty Smith, 80, both wearing the old-school red Star Trek shirts. Both said they hope the town embraces its new Trek-heavy theme.

For Jesse Zelisko, the 15-year-old who donned the elaborate sehlat costume, Star Trek has always been a part of living in Vulcan.

“If you say southern Alberta, people know Vulcan,” says Zelisko. “It’s always been that Star Trek town.”

But while the connection is hardly new, Vulcan got a major push in that direction last year. That was when Nimoy famously got behind the town’s failed bid to hold the premiere of J.J. Abrams’ 2009 Star Trek film series reboot. Nimoy, who was the only original cast member to star in the film, read a Calgary Herald news report online that the town had been denied the premiere and decided to lend his support.

“We made some phone calls and one thing led to another,” said Nimoy, in an interview with the Herald prior to the event. “When Paramount got to thinking about it they thought they would show it in Calgary and bus 300 people in Vulcan, which I thought was great. But it just touched me as a very interesting problem that Vulcan couldn’t get a screening of the movie.”

Vulcan has already felt the benefits of Nimoy’s plug. In 2009, it had 23,400 visitors come through town looking for Trekkie adventures. That’s up from 16,800 in 2008. Now endorsed by CBS Television, which owns the licensing rights to Star Trek memorabilia, the town has been able to offer a new line of items at its tourism centre.

It’s working. Eric Anderson, a 28-year-old Trekkie from Regina, said he spent “way too much” money there Friday morning.

“I bought this shirt, and it was cool because they had these limited-edition posters,” he enthused, showing off a new T-shirt design with the words “Spock Beamed Down to Vulcan.”

“I think there’s only 500 available. I bought a Spock bobble-head doll and some knick-knacks . . . I sound like such a dweeb right now.”

Take our FREE Online Assessment Today!

Socialize with Abrams & Krochak

Nepal adoption suspension riles Canadians

Take our FREE Online Assessment Today!

Socialize with Abrams & Krochak

Canadian ePassports to launch in 2012

Passport Canada plans to launch an ePassport in 2012, and in the meantime it wants to hear Canadians’ thoughts on the issue including revised fees.

The new passport will be little changed in appearance but will contain an electronic chip encoded with the bearer’s name, gender, and date and place of birth, as well as a digital portrait of the traveller’s face.

“The use of ePassports will allow Canada to follow international standards in the field of passport security to protect our borders and maintain the ease of international travel that Canadians currently enjoy,” Passport Canada said in a release.

With the launch of the new passport, Canadians will also be able to choose whether they want a passport valid for 10 years or for the current five-year period. Along with the changes will come new fees a development that requires consultation with Canadians, under the User Fees Act, according to the agency.

Canadians are asked to fill out an online questionnaire on Passport Canada’s website by May 7. The comments will be considered in the development of the new passport and its fees.

Take our FREE Online Assessment Today!

Socialize with Abrams & Krochak

March with no snow first on record

There has never been a March in history when there haven’t been any flakes of snow. Until now.

“There no snow in downtown this March – not even a trace amount recorded,” said David Phillips, senior climatologist at Environment Canada, since record keeping began in 1845. “It’s really astounding!”

This lack of snow beats the previous record of 1898 when trace amounts of snow – less than 0.2 centimetres – were seen downtown at the University of Toronto downtown campus. Normally, March in Toronto means an average of 22 centimetres of snow spread over nine to 10 days.

What makes this particular winter even more astounding, says Phillips, is a snowless November and March. “It seems like winter has been confined to three months instead of the normal six months,” he said, adding that it has snowed only between Dec.1 and Feb. 27 so far.

“Winter came in like a lamb, and went out like a lamb,” Phillips said. “We really didn’t see any lion-like weather.”

There is a chance that some more records will be broken. Toronto has only seen 46.2 centimetres of snow this season compared to the existing record of 47.1 centimetres in the winter of 1952 to 1953. On average, Toronto gets over 127.1 centimetres of snow every year.

This pattern of snowlessness has been echoed across the province. “The snowiest country in the world has got almost no snow in comparison,” Phillips said.

The record breaking pattern is expected to continue into the long weekend. Environment Canada is predicting 23 degrees Celsius on Friday, which would beat the current warmest temperate for April 2 set in 1967 at 20.6 degrees.

“We’ve got many indignant people telling us its to early for an April fool’s day joke, but it really isn’t,” Phillips said. “It’s going to be a spectacular summer-like weekend.”

Take our FREE Online Assessment Today!

Socialize with Abrams & Krochak

Archives

- November 2025

- June 2025

- March 2025

- February 2025

- December 2024

- October 2024

- June 2024

- May 2024

- April 2024

- January 2024

- November 2023

- July 2023

- June 2023

- May 2023

- January 2023

- November 2022

- April 2022

- March 2022

- February 2022

- October 2021

- June 2021

- April 2021

- October 2020

- September 2020

- June 2020

- May 2020

- April 2020

- March 2020

- December 2019

- January 2019

- December 2018

- November 2018

- August 2018

- June 2018

- April 2018

- January 2018

- December 2017

- November 2017

- April 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- August 2015

- January 2015

- December 2014

- November 2014

- June 2014

- April 2014

- March 2014

- February 2014

- December 2013

- May 2013

- April 2013

- January 2013

- December 2012

- August 2012

- June 2012

- March 2012

- January 2012

- September 2011

- August 2011

- July 2011

- June 2011

- February 2011

- January 2011

- December 2010

- November 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008